Tired of Complex TDS Compliances?

Simplify TDS Return Filing with India's Most Trusted TDS/TCS Software

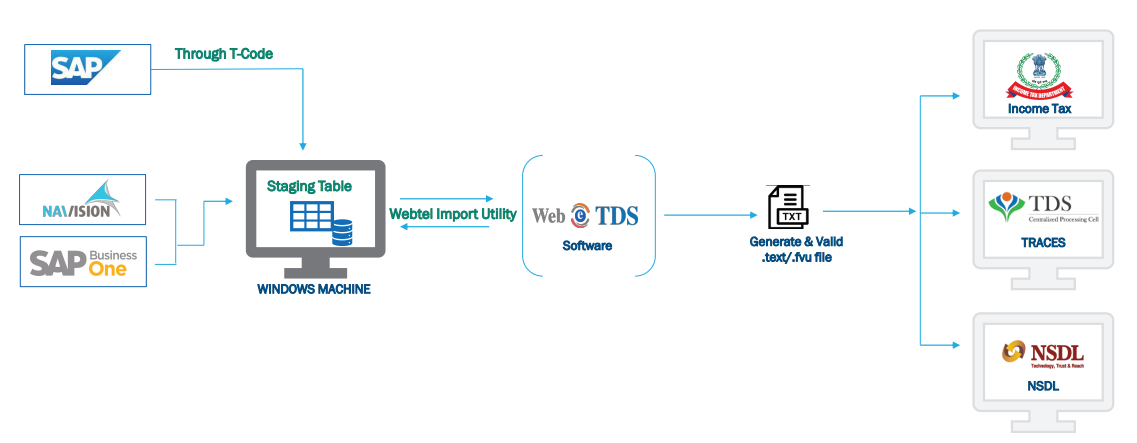

Seamlessly integrated with TRACES and NSDL Portal.

Bulk emailing and sharing of TDS certificates in Form 16/16A.

Excel utility to import data & generate TDS Returns also available

Advance Default Predictor (ADP) to know & correct errors before filing.

One step Bulk PAN Validation of employees & parties